In a year of disappointing tech IPOs, WeWork stood out for its meteoric rise and fall before the company ever went public.

The company’s core business is converting leased buildings into co-working spaces that offer perks like yoga classes and kombucha taps.

The plans to go public disintegrated after investors questioned the company’s valuation as well as the leadership of former CEO Adam Neumann.

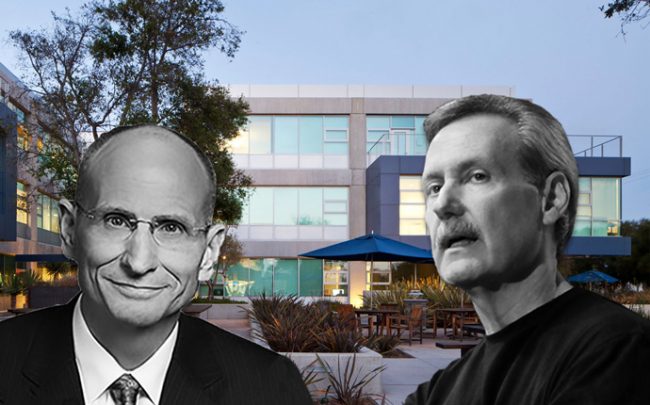

Neumann stepped down as CEO in September and was replaced by two co-CEOs: Artie Minson, formerly the company’s co-president and chief financial officer; and Sebastian Gunningham, who was vice chairman.

Last month, SoftBank announced a $9.5 billion deal to take control of WeWork.

The news of the job cuts was reported earlier by the New York Times, which said WeWork’s plan involved laying off 2,000 to 2,500 people from the company’s core real estate business.

Another 1,000 employees would leave as the company sells or closes its other businesses including a private school, and 1,000 building maintenance workers would be transferred to a contractor, the Times reported.